Introduction

The powerful Dutch tech company ASML is at the center of its Silicon Valley.

Three times quicker than a human rocket, an item resembling a thick pizza box and containing a silicon wafer takes off ten times per second. It travels at a steady speed for a few milliseconds before coming to an unexpected, amazingly precise stop within one atom of its objective. This experiment does not involve high-energy physics.

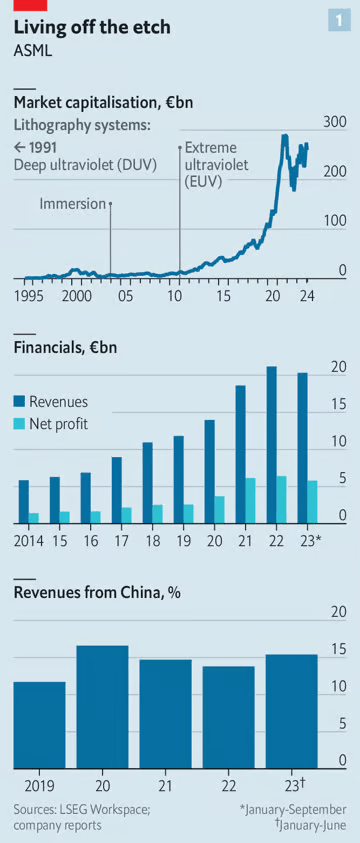

Yet ASML, S spectacular success is also underpinned by two other less obvious factors the company has created a network of supplies and technology partners that may be the closest thing Europe has to Silicon Valley, and its business model ingeniously combines hardware with software and data

It is the most recent lithography device that ASML, a producer of chipmaking tools to transfer micron-sized chip designs onto silicon sheets. January 5th intel an American semiconductor behemoth, became the first proud owner of the first parts of this technological marvel to be assembled at its factory in origin

European Startups and Innovation Silicon Valley

The startup scene in Europe is flourishing and promoting innovations in various sectors. We explore the main industries where European entrepreneurs are having a big influence, from health tech to sustainable energy.

Following many years of technological domination in Silicon Valley, California, especially by companies such as Google and Facebook, it appears that Europe is prepared to take the lead.

The European Commission will present its plan to create a “single digital market,” which would include all 28 EU members, on May 6. The digital commodities, capital, content, and services of Europe will be consolidated into the upcoming marketplace.

According to reports, the approach is motivated by American digital companies’ incursions into industries that Europe has traditionally regarded as their domains, such as manufacturing, networking infrastructure, and automobiles. Together, the sectors account for tens of millions of jobs and enterprises throughout Europe in Silicon Valley

Despite the importance of these business sectors to Europe’s economy, statistics from the commission show that 41% of EU companies do not use digital technology at all. Commissioners believe that this is the right time to support innovation in European businesses, move them into the digital era, and hope that this will help bolster the slow recovery occurring in most of Europe since 2008.

This is because more objects are being connected to the Internet and can function almost independently thanks to the Internet of Things.

The strategy paper from the commission states, “Barriers that do not exist in the physical single market are holding the European market back.” A draft copy of the document was obtained by the Wall Street Journal According to the paper, a unified digital market has the potential to generate up to $365 billion in GDP for Europe, generate 3.8 million employment, and reduce public administration expenses by up to 20%.

Restoring Europe’s position as a global leader in information and communications technology is the goal.

Even the plan is divided into phases. The first step is to reduce the obstacles to online cross-border activities. Currently, these obstacles include inconsistent copyright, consumer protection, tax, and contract laws among member states; incompatible and uncompetitive package delivery services; complex VAT regulations; and convoluted dispute resolution processes Silicon Valley

The commission suggests a single audit as a remedy for businesses that conduct cross-EU sales. The intention is to make it simple enough for the majority of firms to implement electronic signatures online and go pan-European in less than a month.

According to the Wall Street Journal, deputy president of the European Commission for the digital single market Andrus Ansip stated, “The message Europe is sending its entrepreneurs now is: stay at home.”

“Technology companies cannot expand in Europe due to 28 different laws, even though Europe has a 500 million potential customer base compared to the U.S.’s 350 million.”

The strategy’s second phase establishes fair competition for businesses and services in the same market. Search engines, app stores, and social media have “rapidly and profoundly challenged the status quo” and grown enormously, according to the report, which did not mention any specific companies in Silicon Valley

The report then describes a review procedure that will be used by companies operating in these domains to identify and get rid of potentially deceptive terms of service, deceptive tactics, opaque pricing policies and search results, and the use of personal information for targeted advertising and profiling.

Ansip stated to The Wall Street Journal that the digital single market policy “in no way” seeks to impede the expansion of American tech companies in Europe, notwithstanding this regulatory focus in Silicon Valley.

Significant alterations to the European telecom industry are also mandated by the digital market plan. One upgrade to the radio spectrum allotment auctions is one of the specific changes. Telco operators can now launch mobile Internet services like fourth-generation wireless networks, or 4G, thanks to those auctions.

The commission will recommend that, to curb overly inflated pricing in certain countries (which is impeding development and leaving southern and eastern member states with 3G and in some cases 2G connections), licensing conditions, such as time limits on auctions and coverage requirements, should be harmonized across the EU. Revenues from spectrum sales remain with member states.

It’s possible that telco reform would lead to more regulation of over-the-top (OTT) services, such as Facebook’s WhatsApp. Many European carriers have advocated for this as voice and SMS call revenues are dropping and millions of customers are switching to these services.

According to Facebook, over-the-top messaging forces users to upgrade to higher data plans to meet their messaging needs, which generates significant income for telcos.

The commission wants this plan implemented within the next two years. Ultimately, the aim is to create a unified European market to rival and balance companies headquartered in Silicon Valley.

Conclusion

Europe is emerging from Silicon Valley’s shadow as it rises to the challenge. Europe has a strong ecosystem, government backing, and a distinct cultural perspective on technology, making it a credible challenger to Silicon Valley hegemony.